Exploring the nuances between Trip Insurance and Credit Card Protection, this article sheds light on the essential disparities that can impact your travel decisions. From coverage details to cost analysis, let's delve into the intricacies of these financial safeguards.

Trip Insurance Coverage

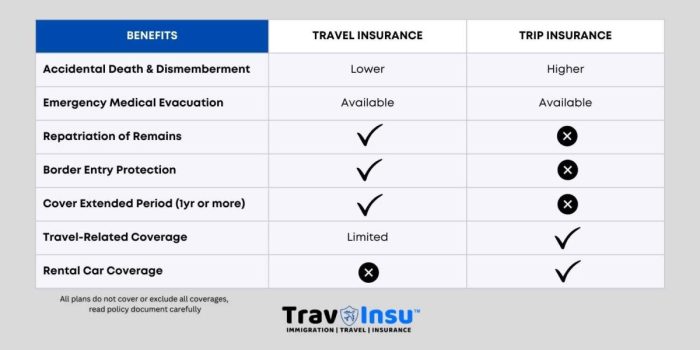

Trip insurance offers a variety of coverage options to protect travelers from unforeseen circumstances that could disrupt or cancel their trip. These coverage options can vary depending on the insurance provider and the specific policy chosen.

Types of Coverage Offered

- Trip Cancellation: Reimburses non-refundable trip costs if the trip is canceled for a covered reason such as illness, injury, or severe weather.

- Travel Delay: Provides coverage for additional expenses incurred due to a covered delay, such as accommodation and meals.

- Baggage Loss: Reimburses for lost, stolen, or damaged baggage during the trip.

- Emergency Medical: Covers medical expenses incurred due to illness or injury while traveling.

Scenarios where Trip Insurance is Beneficial

- Medical Emergency: Trip insurance can cover emergency medical expenses if you fall ill or get injured during your trip.

- Trip Cancellation: If you need to cancel your trip due to unforeseen circumstances like a family emergency, trip insurance can help recoup your non-refundable expenses.

- Travel Delay: In case your flight is delayed and you incur additional expenses for accommodation and meals, trip insurance can provide coverage.

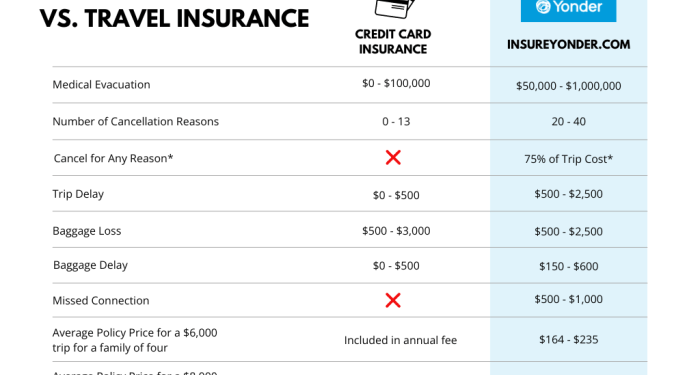

Comparison of Coverage Limits

Different trip insurance providers offer varying coverage limits for each type of coverage. It is essential to compare the coverage limits, exclusions, and terms of each policy to ensure you select the one that best fits your travel needs and budget.

Credit Card Protection Benefits

When it comes to trip-related expenses, credit cards offer certain protections that can be beneficial for travelers. These protections vary among different credit card issuers and can provide a safety net in case of unforeseen events.

Types of Credit Card Protection

- Travel Insurance: Some credit cards offer travel insurance coverage, including trip cancellation or interruption insurance, travel accident insurance, and lost baggage reimbursement.

- Rental Car Insurance: Many credit cards provide rental car insurance coverage, which can save you money on purchasing insurance from the rental company.

- Emergency Assistance: Credit cards may offer emergency assistance services, such as medical or legal referrals, in case of emergencies while traveling.

- Purchase Protection: Certain credit cards offer purchase protection, which can reimburse you if your purchases are damaged or stolen within a certain timeframe.

Limitations of Credit Card Protection

- Coverage Limits: Credit card protections often come with coverage limits, which may not fully cover all expenses in case of a major incident.

- Exclusions: Credit card protections may have exclusions for certain types of trips, activities, or pre-existing conditions that trip insurance would typically cover.

- Claim Process: The process of filing a claim with credit card protection can be more complex than with trip insurance, requiring specific documentation and adherence to strict timelines.

Variations Among Credit Card Issuers

Credit card issuers may offer different levels of protection and benefits, so it's essential to review the terms and conditions of your specific credit card before relying solely on its protection for your trip. Some premium credit cards may provide more extensive coverage than basic cards, so it's worth exploring your options based on your travel needs.

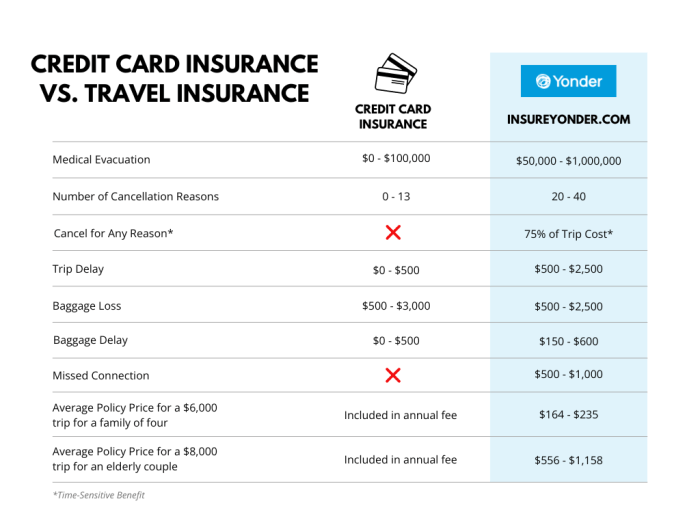

Cost Analysis

When it comes to cost, comparing trip insurance and credit card protection is crucial to determine the most cost-effective option for your travel needs.

Breakdown of Costs Associated with Trip Insurance

Trip insurance costs can vary depending on factors such as your age, trip duration, destination, and coverage limits. On average, trip insurance can range from 4% to 10% of the total trip cost.

- Premiums: The cost of the insurance policy itself.

- Policy Limits: The maximum amount the insurance will pay out for covered expenses.

- Deductibles: The amount you must pay out of pocket before the insurance coverage kicks in.

- Add-Ons: Additional coverage options that can increase the overall cost.

Comparing Cost-Effectiveness of Trip Insurance vs Credit Card Protection

While credit card protection may offer some coverage for trip-related issues, it is important to note that it may not provide as comprehensive coverage as trip insurance. In terms of cost-effectiveness, trip insurance can be more beneficial in scenarios where extensive coverage is needed, such as medical emergencies, trip cancellations, or lost baggage.

Factors to consider when evaluating the financial implications of each option include:

- Level of Coverage: Assess the extent of coverage provided by both trip insurance and credit card protection.

- Cost of Trip: Consider the total cost of your trip and whether the coverage limits of each option align with your needs.

- Risk Tolerance: Evaluate how much financial risk you are willing to take in the event of unforeseen circumstances during your trip.

- Travel Frequency: If you travel frequently, investing in an annual trip insurance policy may be more cost-effective than relying on credit card protection for every trip.

Claim Process and Requirements

When it comes to filing a claim with trip insurance companies, the process typically involves notifying the insurance provider as soon as an incident occurs during your trip. This could be anything from a canceled flight to a medical emergency.

You will need to provide documentation to support your claim, such as receipts, medical reports, and any other relevant evidence.

Trip Insurance Claim Process

- Notify the insurance provider immediately after the incident.

- Gather all necessary documentation, including receipts and reports.

- Fill out the claim form provided by the insurance company.

- Submit the claim form along with all supporting documents.

- Wait for the insurance company to review your claim and make a decision.

Trip Insurance Claim Requirements

- Receipts for any expenses incurred as a result of the incident.

- Medical reports or documentation for any medical emergencies.

- Evidence of the incident, such as police reports or flight cancellation notices.

- Completed claim form provided by the insurance company.

Comparison with Credit Card Protection

When comparing the claim process and requirements between trip insurance and credit card protection, it's important to note that credit card protection may have different procedures and documentation requirements. With credit card protection, you may need to contact your credit card company directly to initiate a claim, and the documentation required could vary based on the specific benefits offered by your credit card.

End of Discussion

In conclusion, understanding the disparities between Trip Insurance and Credit Card Protection is crucial for making informed choices when it comes to safeguarding your travel expenses. By weighing the benefits and limitations of each option, travelers can navigate unforeseen circumstances with confidence.

Top FAQs

What types of scenarios are covered by trip insurance?

Trip insurance typically covers trip cancellations, delays, medical emergencies during travel, lost luggage, and other unforeseen events that may disrupt your trip.

What are the limitations of credit card protection compared to trip insurance?

Credit card protection usually has lower coverage limits and may not provide as comprehensive coverage as trip insurance, especially for medical emergencies and trip cancellations.

How do the claim processes differ between trip insurance and credit card protection?

Filing a claim with trip insurance requires specific documentation related to the incident, while credit card protection may have stricter requirements and limitations on what expenses are covered.